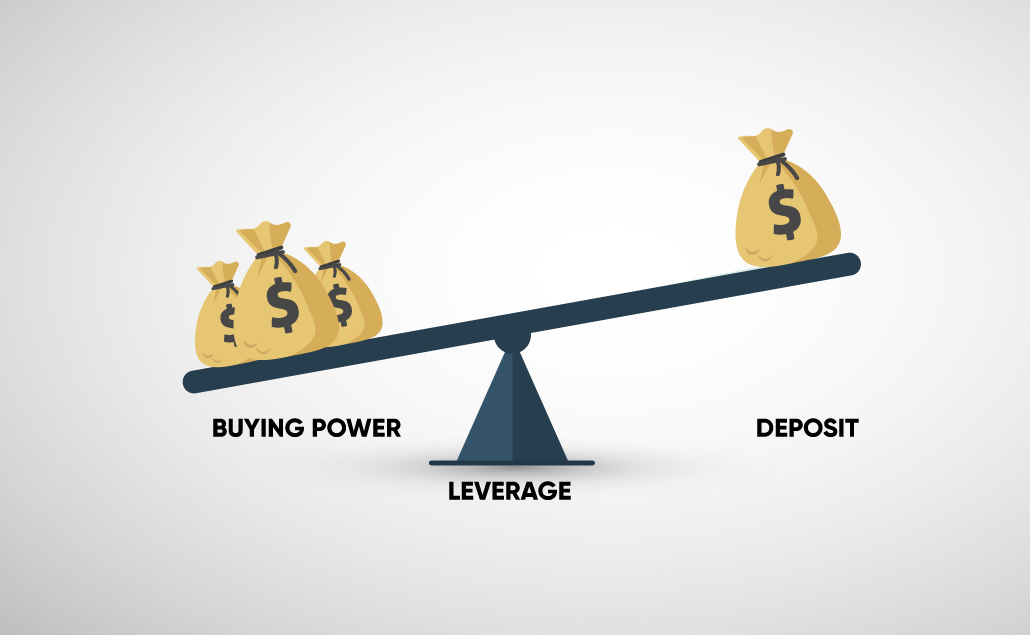

Margin in trading refers to the practice of utilizing leverage to increase the potential returns from the purchase and sale of securities. In simple terms, it is the borrowing of money from a broker to purchase securities. This practice can help traders increase their buying power, allowing them to make bigger trades than what their actual funds would allow.

In this article, we’ll take a closer look at what margin in trading is and how it works.

What does Buying on Margin Mean?

Buying on margin is a type of investment strategy that involves purchasing an asset, such as stocks, using borrowed funds provided by a broker. The borrower receives a loan from the broker, typically in the form of cash, and uses it to purchase the asset. The borrower will then pay back the loan plus interest, using the proceeds from any future sale of the asset.

This type of investment technique is generally considered to be riskier than investing with cash.

How Do You Buy CFDs on Margin?

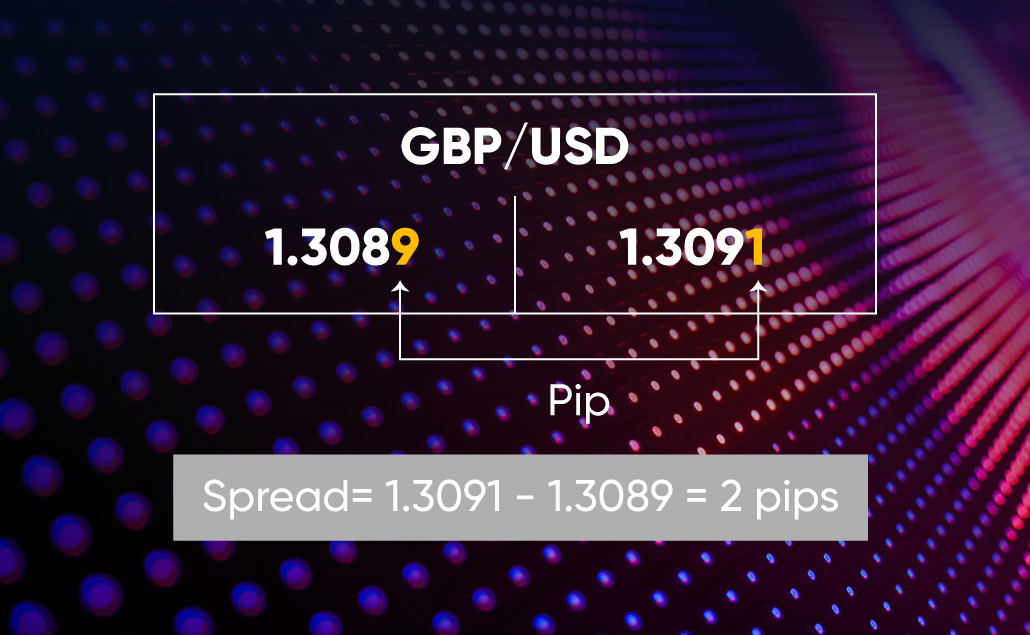

CFDs are derivatives products that are traded on margin. They allow traders to open a position based on the exact amount of money a trader is willing to risk (the margin).

To buy CFDs on margin, first, you need to open an account with a CFD broker. Next, you’ll need to select the CFD you wish to trade, and then decide how much leverage you would like to use. Different brokers allow for different amounts of leverage, so it’s important to check their leverage policy before deciding how much risk you would like to take. With a CFD broker, you can then place an order and the broker will execute the purchase at the market price.

Once the trade is complete, your account will be credited with the difference between the purchase and sell prices.

What is a Margin Call?

A margin call is a broker’s demand for an investor who has purchased securities on margin to deposit additional funds in order to bring the margin account up to the minimum maintenance margin requirement. It is a warning that the investor’s equity in the account is falling below a certain level, and if it continues to decline, the broker may need to liquidate the investor’s holdings to cover the margin loan.

What Is Free Margin?

Free margin is the amount of money in your trading account that is available to open new positions. It is the difference between the equity in your trading account and the margin that is used to maintain open positions. It can be used as a tool to measure the risk level of a position.

The Risks and Benefits of Buying on Margin

The risks of buying on margin are as follows:

- Margin Calls: A margin call occurs when the value of a margin account falls below the margin maintenance requirement set by the broker. If this happens, the trader must deposit more money or securities in order to meet this requirement or face the risk of their position being liquidated.

- Unforeseen Price Action: Margin trading carries the risk of unforeseen price action that can cause higher losses than what the trader initially predicted. This can occur if the trader’s position moves against them and they are unable to close it in time before a large decrease in the market value.

- Liquidation Risk: If a trader’s account runs out of money or the market prices move against the trader, their positions may be liquidated. This means their broker will close out the trades and the trader is liable for any losses and fees associated with the liquidation

- Leverage Risk: Leverage can be both a benefit and a risk. When the market moves in a favorable direction, leveraging can allow a trader to make higher profits than if they simply invested the same amount of money without leverage. On the other hand, when the market moves in an unfavorable direction, leveraging can magnify losses and leave the trader in a negative position

While the benefits are:

- Increased Potential Profits: By leveraging their capital, margin traders can increase their potential profits. Leveraging allows traders to invest more money than they normally would be able to while using only their own capital. This can end up increasing their profits significantly

- Lower Transaction Costs: Since the money used to make trades is effectively borrowed, the transaction costs are generally much lower on a margin account than on a regular trading account. This means traders can make more transactions with less capital, potentially increasing their profit

- Easy Access to Capital: Margin accounts provide traders with easy access to capital, which can be used to fund more trades or to increase their trading size on existing positions. This can be beneficial to traders who don’t have a lot of capital to start with, but still want to trade.