Stock trading is where you buy and sell shares in companies to make a profit. A share is the same as stock; therefore, stock traders are people who buy and sell parts of companies to one another. Stock trading is typically higher volume and conducted over shorter time periods than investing, which is more focused on ownership over the long term.

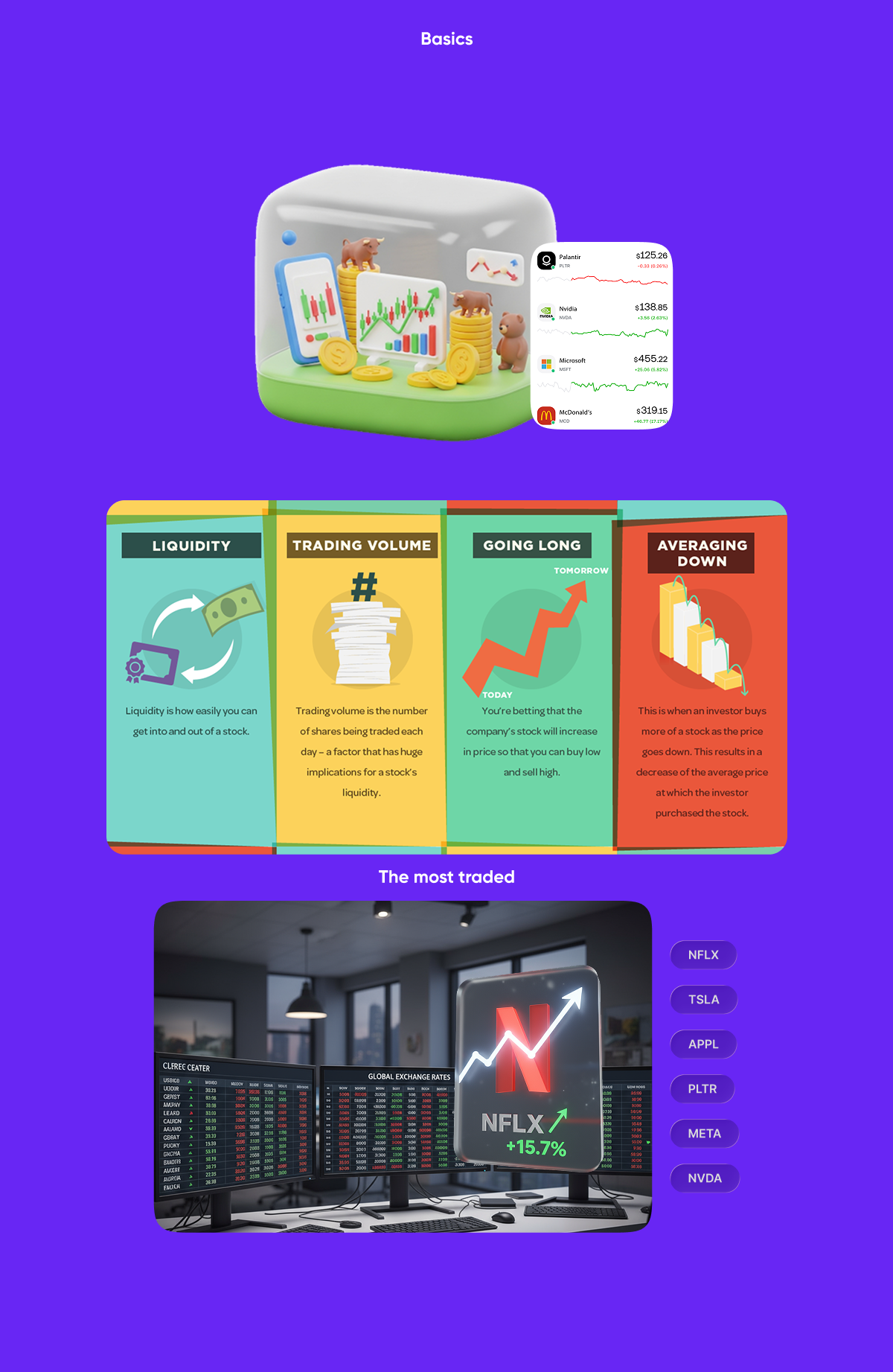

Stock traders will look to buy low and sell high, with the difference being the profit they walk away with. Predicting when the value of a company will rise or fall, and by how much, requires a large number of economic indicators and financial tools. Stock traders will typically look for:

Being a stock trader requires you to understand how global events impact the wider economy as well as how they will influence a specific industry and company. Interest rates and inflation will impact every listed company, but other factors such as market size and consumer spending power will influence different companies in different ways.

Supply and demand are the two fundamental factors that will set the stock price of any given listed company. If a company has a lot of products and everyone wants to buy them, it will make a lot of money. But if they have too many products sitting as inventory and aren’t selling them, they are losing money, and the stock in them will be worth less. Generally speaking, the more profit a company makes, and the more confidence there is that it will continue to make even larger profits, the more valuable its stock will become.

A stock trader will also be on the lookout for the next big thing. A good example of this right now is the surge in spending when it comes to AI development. If a stock trader is able to adopt a position in a startup before it is sold to a major competitor, they could make a substantial return. Likewise, if a stock trader shorts the stock of an AI company that is about to announce redundancies, they will stand to profit.

Our new guide on how to start stock trading is the perfect next step to take when you want to become a stock trader. It will dive deeper into the strategies of stock trading and the mechanics of making trades, all so you can get up to speed much more efficiently.

Because Eurotrader is one of the leading stock trading platforms in the world, you will be able to get everything you need from a single source. Ideal when you want to be able to set the tone for a diverse and highly lucrative investment portfolio across a wide range of assets