Contract For Difference (CFD) trading is essentially a smart financial bet on whether the price of an asset will go up or down. While many forms of traditional trading require you to buy and sell the asset itself, CFD frees you from this obligation. The advantage of doing this is that you can use leverage to hold much bigger positions with much capital.

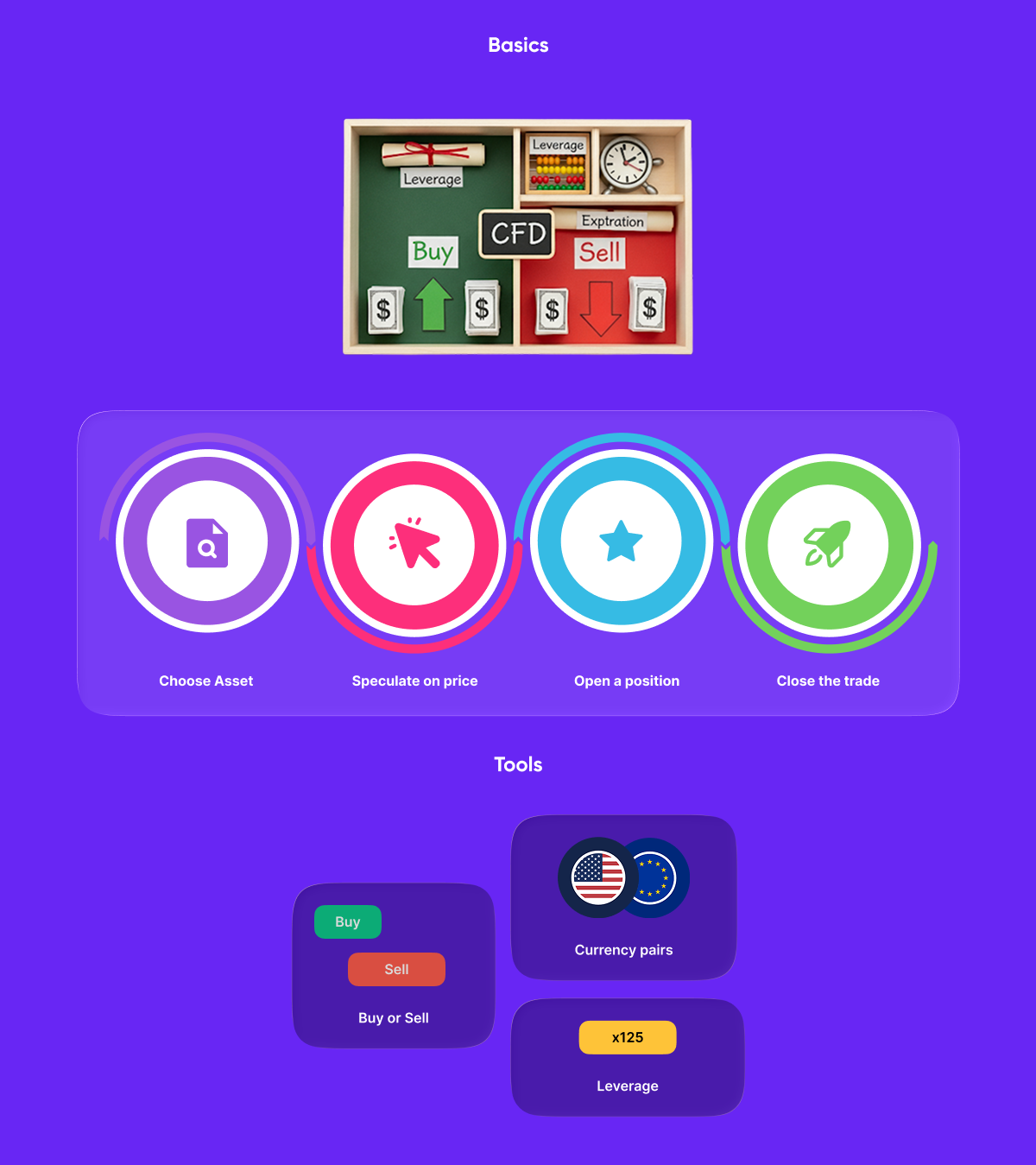

Elite traders and institutional investors routinely take a CFD approach to trading because it frees them from having to own the underlying asset. Rather than housing the asset and taking care of all the associated costs with having it on their balance sheet, they can focus on interpreting the market. Here are the basics of how it all works:

The main factor that will dictate the success or failure of a CFD trading strategy is the trader’s ability to read the market. Smart traders make their profits by opening and closing winning positions before the crowd.

There are additional advantages of CFD trading compared to traditional trading that may help you decide if it is the right approach for you.

As well as not having to own the underlying asset, CFD trading allows you to take advantage of several potentially highly lucrative options:

CFD traders are able to gain a deeper understanding of risk and exposure to the market, and they are not left holding a potentially worthless asset if the market crashes. That said, it is important to understand that highly leveraged positions can work in reverse and lead to large losses if improperly managed.

Eurotrader is a trusted platform for traders of all abilities who want to move into CFD markets.

The complex nature of some of the more advanced CFDs is one of the reasons why we offer a comprehensive range of resources to bring you up to speed before you know it.

Taking a little time to read our guide on how to start CFD trading will show you how this potentially highly lucrative approach to trading works in more detail. We are always available to guide you through your options and help you make your first CFD trade when you feel ready.

Eurotrader is a brand name used by Eurotrade International Ltd, a company registered in Mauritius with Business Registration Number 197389 GBC and registered address at 3 Emerald Park, Trianon, Quatre Bornes 72257, Republic of Mauritius ,authorized and regulated by the Mauritius Financial Services Commission (License Number GB22201125 ) as an Investment Dealer. Risk Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Read our full Risk Disclosure. The information on this site is not directed at residents of United Kingdom, Canada, Japan, Australia, the United States, Belgium or any particular country inside the EU and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our Legal.

Copyright © 2018 – 2025 Eurotrader, All rights reserved.