Index trading is a straightforward process, even if you’re a beginner in the craft. Follow our guide and you’ll start trading like a pro in no time.

Choose a broker

The first step to trading indices is to find an index trading broker. An index trading broker is a platform where you can buy and sell contracts to track the price movements of these indices. They are basically platforms that give you access to trade indices.

Before selecting one, you must consider the available assets, fee structure, the variety of tools on the site, and the ease of using them. Eurotrader is one of the few brokers that fits this criteria, with high leverage, a fast onboarding process, and numerous instant payment methods.

Select Your Indices

Next is to pick the indices you wish to trade. If you prefer short-term trading, Germany 40 is not a bad choice. If you want to trade for a long time and get steady returns, US 500 is a good choice. Your choice of index also depends on your investment goals, what you know about the market, and how much risk you can take.

Analyze the market

Discern the direction of the market using fundamental analysis, technical analysis, or a mix of both. Fundamental analysis checks economic data; it considers events related to a country’s politics and national earnings. Technical analysis, on the other hand, uses tools like charts and indicatorsPick a Trading Strategy

Before you put money into this craft, it’s important to decide if you’re going long or going short. Going long means you’ve foreseen the value of an index rising, in which case, you “buy” when opening your trade. Going short is an option when you expect that index to fall in value. Hence, you start your trade with a “sell.”

Implement Risk Management Strategies

Trading indices comes with its opportunities and risks, but you can curb the amount of risk you take with the right strategy. You could choose to use proper position sizing to prevent excessive leverage or keep an eye on economic reports so you know when they’ll impact the index. There’s also the option of setting up stop-loss orders that will automatically close your trade when the loss reaches a certain level.

Open a Trade and Monitor It

Now that you’ve taken all the preparatory steps, it’s time to open a trade. Log into your index broker platform and select from options, cash, or futures trades. An Options trade is one where you set a price to buy or sell an asset at a particular price before an expiry date. Futures involve speculating on the future price of an asset, while cash trading is the straightforward buying or selling of an asset.

Once you’ve opened a trade, you must monitor your position. This is important to see when you’re making a profit or if you’re about to cut a loss.

If this is your first time trading, you’ve probably wondered, “What are indices?” Indices show the performance of a group of assets in a market or sector. The assets could be stocks, bonds, or other financial tools. The price movements of these assets show how well that sector performs.

For example, the S&P 500 follows the stocks of the 500 biggest companies in the US. The upward or downward value of this index shows whether these companies have an upward or downward trend.

What Is Index Trading?

This is the process of speculating on the price movements of stock market indices. So, you don’t need to own those stocks. All you do is predict whether the price of these stocks will increase or decrease.

Types of Indices in Trading

Although there are numerous types of indices out there, they can all be divided into four categories:

There’s a lot to benefit from trading indices, such as:

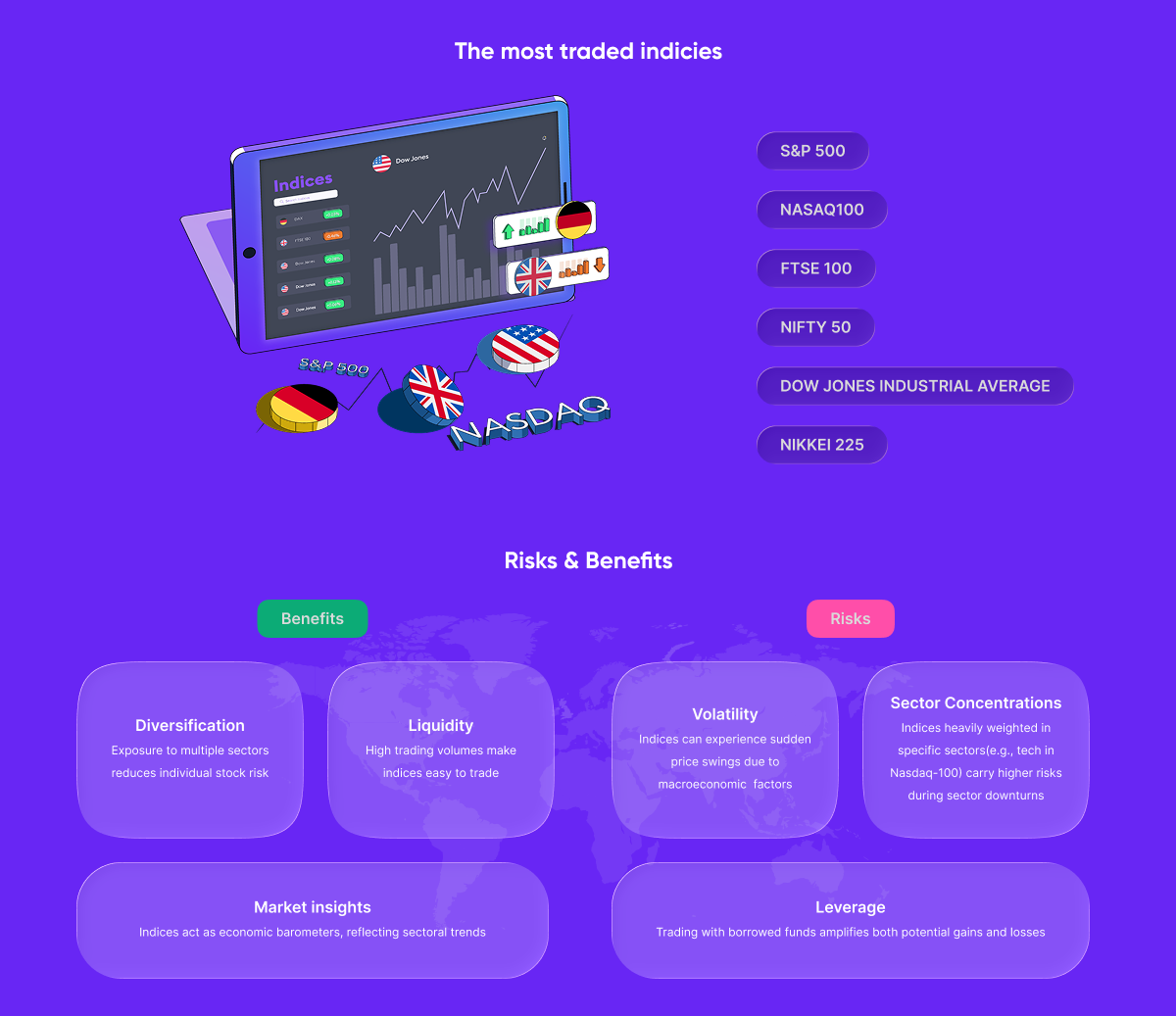

The Dow Jones Industrial Average, DAX, NASDAQ 100, FTSE 100, and S&P 500 make up the major global indices that you can trade.

The money an individual needs to begin trading rests on the broker, the leverage the broker provides, and the sort of trade the person picks. Nonetheless, some brokers let you start with 50 dollars.

ETFs, futures, options, and CFDs are the tools for trading indices.

CFDs allow you to predict the price movements of assets that you don’t own. You simply pick an asset on a CFDs platform (like Eurotrader) and speculate if its index will increase or decrease.

You can trade an index through a reliable broker, like Eurotrader.

Yes, you can use $100 to start trading indices.

Eurotrader is a brand name used by Eurotrade International Ltd, a company registered in Mauritius with Business Registration Number 197389 GBC and registered address at 3 Emerald Park, Trianon, Quatre Bornes 72257, Republic of Mauritius ,authorized and regulated by the Mauritius Financial Services Commission (License Number GB22201125 ) as an Investment Dealer. Risk Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Read our full Risk Disclosure. The information on this site is not directed at residents of United Kingdom, Canada, Japan, Australia, the United States, Belgium or any particular country inside the EU and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our Legal.

Copyright © 2018 – 2025 Eurotrader, All rights reserved.