Commodity trading is the buying and selling of raw materials, such as metals, energy products, and agricultural goods. These assets play a huge part of the world’s economy, and their prices are inherently tied to supply and demand changes, geopolitical environments, natural events, and economic trends.

Trading commodities provides people with a way to speculate on price movements throughout these markets and can help to hedge against inflation and other market volatilities. One of the benefits of reliable platforms, like Eurotrader, is that traders can access markets across a wide range of commodities with ease.

Before getting started, it’s important to learn how commodity markets work. Commodities can be traded on futures exchanges, or through derivative products, like CFDs.

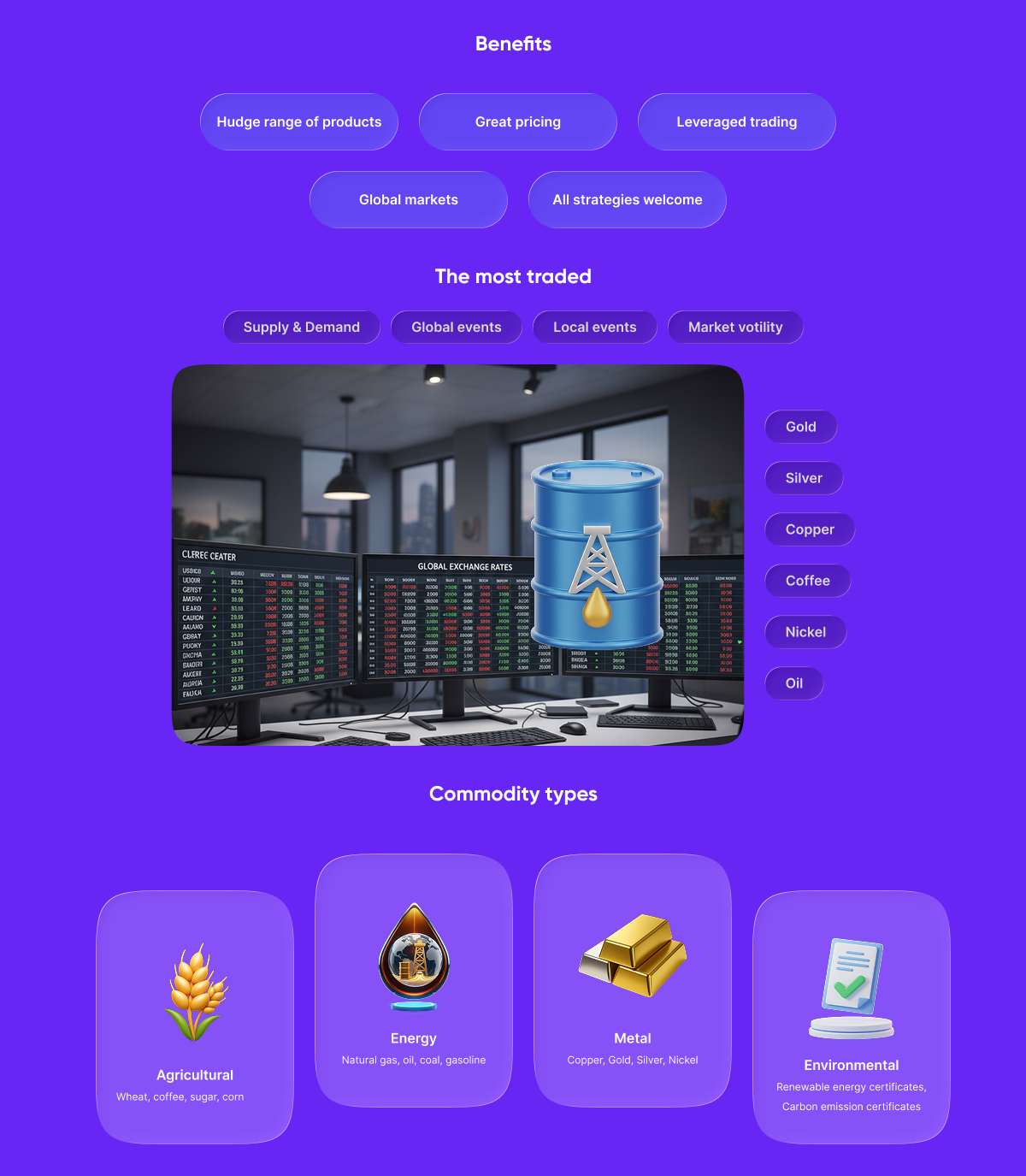

Commodity Trading Types

The next step is to find a reputable commodity trading broker. Eurotrader provides access to key markets and boasts multiple account types, high leverage, access to MetaTrader platforms, as well as rapid onboarding and funding options.

One of the best ways to ease your way into commodity trading is to select one you’re familiar with. For example, lots of beginners choose gold because it has reliable liquidity and it’s easy to find information about the market.

Commodity Consideration Examples

Getting started with commodity trading is a simple process, but the learning curve doesn’t stop there. The next step is to learn how to read the market, and this can be achieved by analysing trends with technical and fundamental tools.

Tool Examples

It’s important to understand that commodity markets can be volatile and trading carries inherent risk. Therefore, risk management must be a priority for anyone jumping into these markets.

Key Risk Management Strategies

Commodities can be traded via futures, CFDs, ETFs, and options. Eurotrader allows users to trade through CFDs, which means you don’t need to own the asset.

The minimum required balance to start commodity trading varies by broker. At Eurotrade, you can start by depositing just $10 ($20 via crypto).

Leverage allows traders to control a large position in the market with a smaller amount of capital. For example, 1:30 leverage means $10 controls $300 worth of commodity exposure. This magnifies both potential gains and losses in the market.

Some of the best commodities for beginners to trade include gold and crude oil. This is because these markets tend to enjoy high liquidity, consistent trading volumes, and can be researched and analysed easily.

Start by learning how the commodity market works and the types of trading (futures, CFDs, ETFs, options), register an account, pick a commodity you understand (like gold, oil, or wheat), and begin trading with small, manageable positions.