The spread is the difference between the buying price (bid) and the selling price (ask) of a currency pair. In simple terms, it represents the trading cost you pay to enter or exit a position. The spread changes continuously depending on market liquidity, volatility, and economic conditions, ranging from a fraction of a pip to several pips. A narrower spread generally indicates a more liquid market, while a wider spread signals higher costs or volatility. For anyone using a professional forex trading broker, understanding how spreads work helps you evaluate true trading costs and overall profitability.

Understanding how the spread works is fundamental for every trader. Generally, the more liquid a currency pair is, the narrower the spread will be, meaning the cost of entry and exit is lower. For example, major pairs like EUR/USD usually have tighter spreads than exotic pairs. Similarly, when volatility or market conditions pick up, spreads will generally widen, meaning the cost of trading goes up. This often happens during major news announcements or unexpected economic events.

By understanding the spread, traders can identify when certain price movements or trends in the currency pair may be beneficial or costly. Being aware of spread fees helps traders determine whether a trade is worth taking. Additionally, with the right strategies in place, traders can capitalize on opportunities when spreads narrow and avoid trades when spreads widen. Monitoring spread changes regularly helps refine entry timing and minimize trading costs.

This approach forms a key part of How to Understand and Calculate Forex Spreads, helping traders make smarter, data-driven decisions across different markets.

Understanding spreads is essential when looking for a stock trading broker or platform, whether you’re into forex, stocks, or commodities.

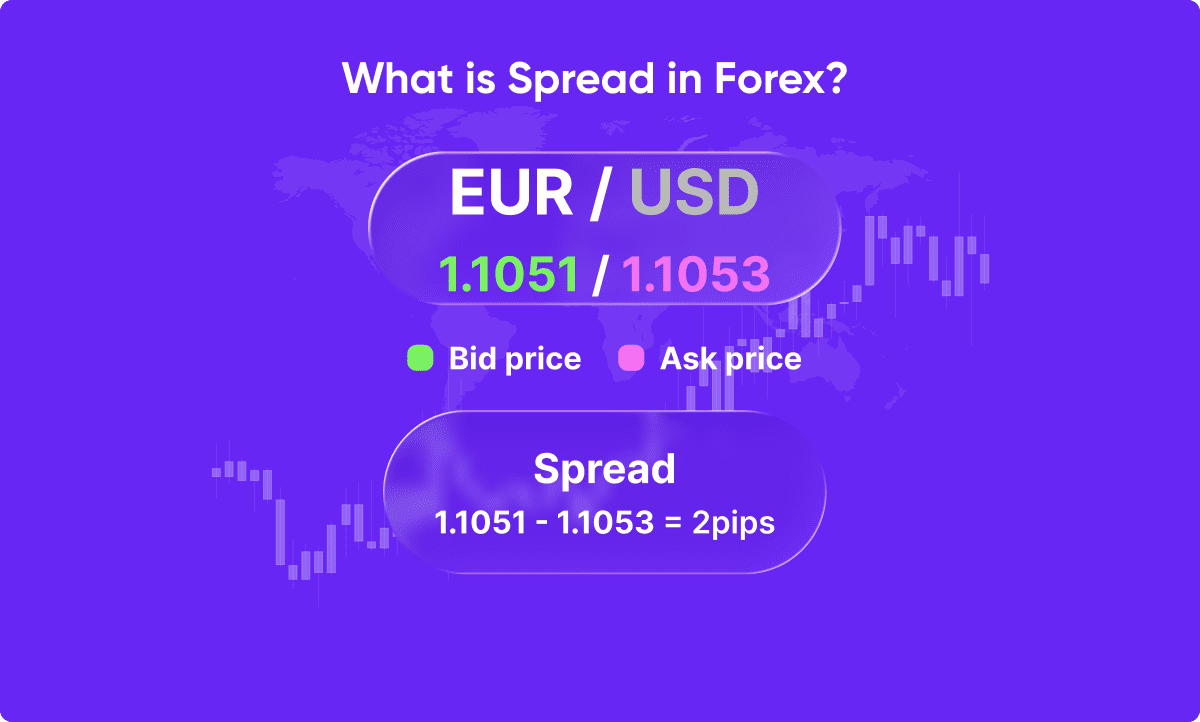

The spread in Forex is typically measured in pips (1 pip = 0.0001) and represents the broker’s implicit commission or cost of execution.

Formula:

Spread = Ask Price – Bid Price

For example, if the EUR/USD bid price is 1.3000 and the ask price is 1.3003, then the spread would be 3 pips (1.3003 – 1.3000 = 0.0003 = 3 pips).

Knowing how to calculate the spread helps you quickly estimate your transaction cost before placing a trade.

Whether you use a commodities trading platform, an index trading service, or a crypto trading app, spreads operate on the same basic principle and understanding them allows for better cost control and trade timing.

The spread is determined by a variety of factors, but primarily by supply and demand. When a currency pair is in high demand, meaning many traders want to buy it, the bid price will be higher than the ask price and the spread will be larger. When demand is lower, the spread will be smaller. Spreads can also be affected by economic events, such as economic data releases, news events, and central bank decisions. Other factors affecting the spread include the liquidity of a currency pair, trading costs, and the broker’s markup. In some cases, a broker may add additional costs to the spread to make a profit.

Check out this piece on How to Trade with Low Spreads for Better Profitability, a strategy that minimizes transaction costs and increases potential returns across all asset classes.

At Eurotrader, we help traders understand spreads and make smarter trading decisions. Our education and tools are designed to help you reduce costs, manage risk, and trade confidently. Join Eurotrader today to enhance your trading journey.