Leverage in forex is a powerful tool that can allow traders to magnify their potential profits as well as their potential losses. Leverage is a feature offered by brokers that gives traders access to larger positions in the financial markets than their account balance would otherwise allow.

Leverage in forex is a powerful tool that can allow traders to magnify their potential profits as well as their potential losses. Leverage is a feature offered by brokers that gives traders access to larger positions in the financial markets than their account balance would otherwise allow.

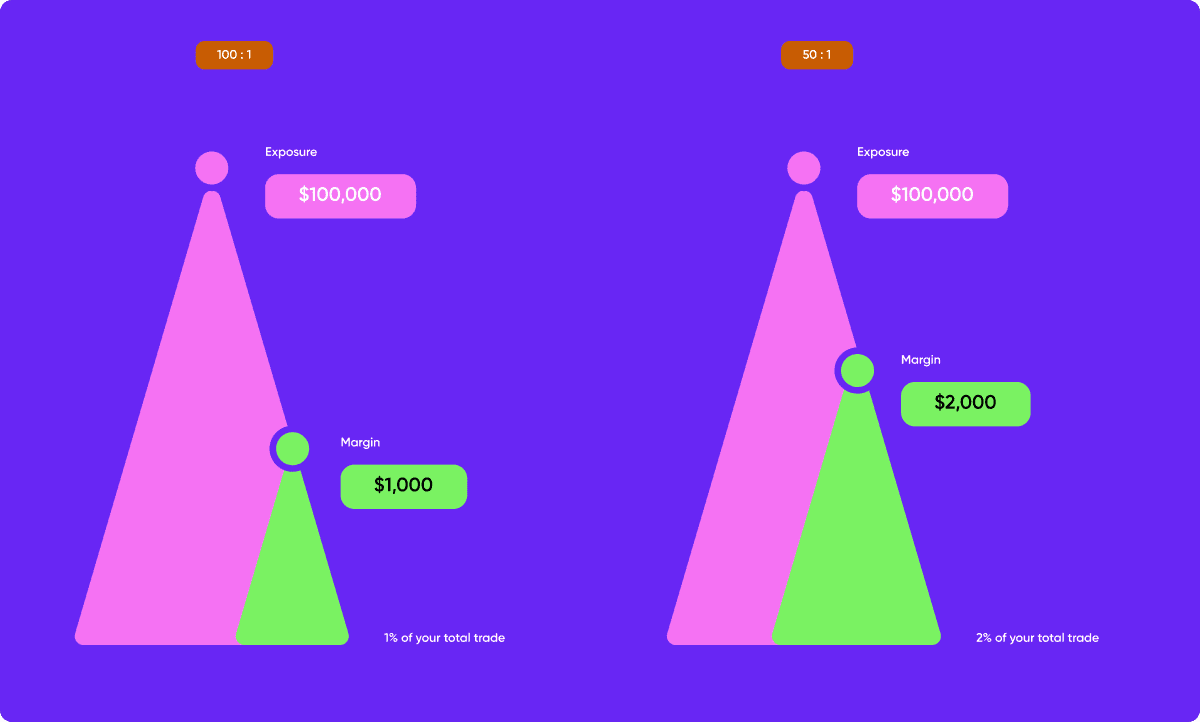

Leverage allows a trader to open a large position with a relatively small investment. For example:

This can be beneficial to traders when markets are on their side, and it can give them the potential to make very large returns on modest investments. For beginners learning how to trade forex, understanding leverage is one of the first and most important steps.

However, leverage can be a double-edged sword, as it can also magnify losses if the market moves against a trader. For example, if a trader opens the above position and the market moves against them, then potential losses could be multiplied by the leverage, and a position worth 10,000 may result in an account balance of zero. Therefore, it is important to be aware of the risks associated with leverage and trade responsibly.

The most common leverage ratios in forex trading are:

These ratios indicate how much capital a trader must provide relative to the position size. For example:

Knowing how to calculate margin in forex is essential, as this determines how much capital you must hold to keep positions open.

Other ways to use leverage include margin accounts and trading derivatives such as CFDs (Contracts for Difference). These allow traders to speculate on market movements without owning the underlying asset, offering higher flexibility but also higher risk.

Leverage increases both potential gains and potential losses. For example:

Leverage should only be used by experienced traders who understand the risks and can manage potential losses responsibly.

At Eurotrader, we’re passionate about helping our members become successful traders. Our forex trading platform offers educational resources, risk management tools, and guidance to help traders use leverage more responsibly. We also provide access to other markets, so whether you prefer a shares trading platform or a commodities trading platform, you’ll find everything in one place.