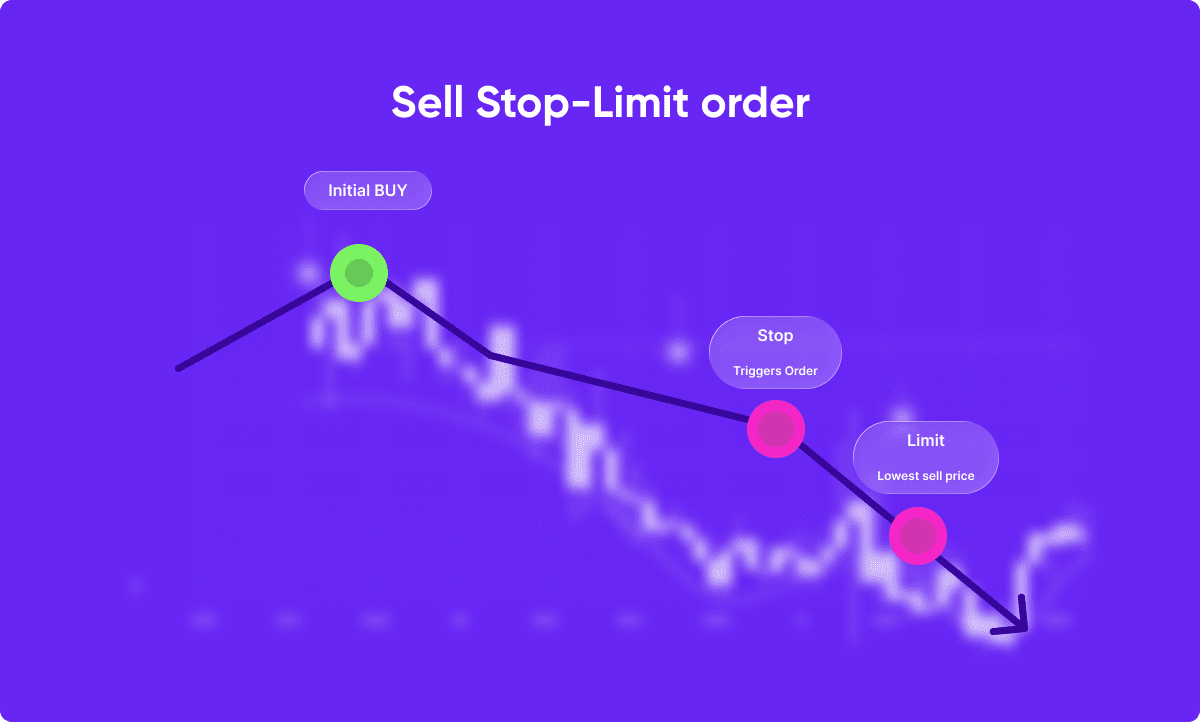

Stop-sell limits are a type of order placed with a broker or other financial institution that instructs them to liquidate a position when it hits a certain value. This type of order helps protect traders from large losses or lock in profits while still holding a position. When a stop-sell limit is triggered, the position is sold at the predetermined price, even if it is lower than the current market price.

Stop-sell limits are also referred to as stop limits because the order is executed only when the security reaches the predetermined stop price. If the price of a security falls to or below the stop price, the order is activated. This allows traders to manage losses more effectively and protect gains if the security later increases in price.

Stop-sell limits are a type of order placed with a broker or other financial institution that instructs them to liquidate a position when it hits a certain value. This type of order helps protect traders from large losses or lock in profits while still holding a position. When a stop-sell limit is triggered, the position is sold at the predetermined price, even if it is lower than the current market price.

Stop-sell limits are also referred to as stop limits because the order is executed only when the security reaches the predetermined stop price. If the price of a security falls to or below the stop price, the order is activated. This allows traders to manage losses more effectively and protect gains if the security later increases in price.

Stop-sell limits are widely used across markets such as shares, where selecting a reliable stock trading broker can make a difference in how quickly and accurately the order is executed.

When choosing a stop-sell limit, traders need to consider their risk level:

Imagine an investor bought 10 shares of Company ABC at $10.00 per share. They set a stop-sell limit of $9.50.

Stop-sell limits are also helpful in broader markets, such as indices, where working with a dependable index trading broker allows investors to manage multiple companies within a sector at once.

Check out our video resources below for more information on how to use Buy-Stop and Stop-Sell and much more on the basics of trading!

Bid and Ask Prices

Knowing how to use a stop-sell limit effectively depends on the market you’re trading in. For example:

Both sell-stop and sell-limit orders are used to control when a trade is executed, but they work in very different ways. The table below highlights the key differences.

| Feature | Sell-Stop Order | Sell-Limit Order |

| Execution Price | At or below the stop price (lower) | At or above the limit price (higher) |

| Trigger Condition | Activated if the price falls to the stop level | Activated only if the price rises and stays above the limit |

| Market Effect | Can trigger on a short dip in price | Requires sustained upward movement |

| Final Execution | May execute at the stop price or slightly lower | Usually executes at the limit price or slightly higher |

At Eurotrader, we’re passionate about helping our members become successful traders. We provide an array of resources and support that make trading easier and more profitable. With our guidance, you can increase your return on investment and optimize your trading strategies. Join the Eurotrader community and start trading today to take your financial goals to the next level.