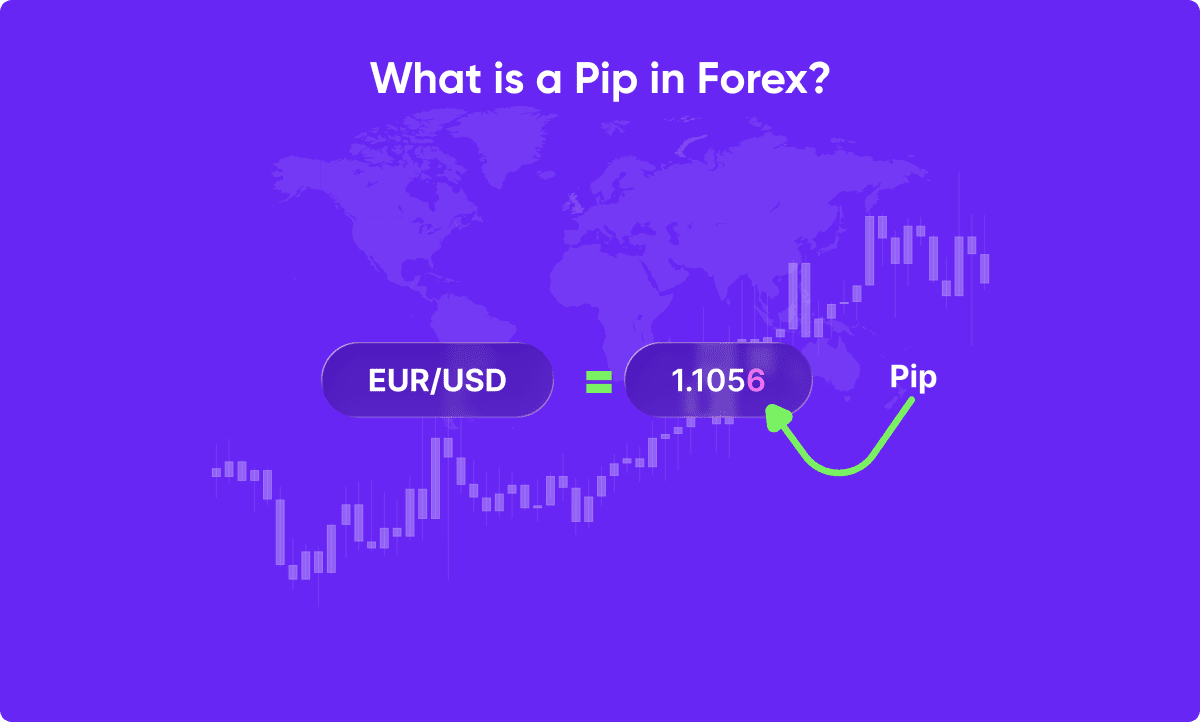

A pip in Forex is a unit of measurement used to measure the fluctuations in the exchange rates of different currencies. It stands for “percentage in point” and is the smallest incremental move that a currency pair can make in the forex market. A pip is usually equal to 1/100th of 1% of the pair’s current value.

In Forex, traders watch the pip movements of a currency pair to establish trends, gauge potential profit and loss opportunities, and determine the overall performance of the currencies being traded. Pips are also used in calculating various features of a currency pair’s performance, such as overall gain or loss and margin requirements.

Forex traders buy and sell a currency whose value is expressed in relation to another currency. Quotes for these forex pairs appear as bid and ask spreads that are accurate to four decimal places.

The value of a pip can also vary depending on what currency pair is being traded. Most pairs go out to four decimal places, but there are some exceptions, like Japanese yen pairs, which go out only to two decimal places. For example, for EUR/USD, it is 0.0001, and for USD/JPY, it is 0.01. This means that a one-pip movement in EUR/USD is smaller in value than a one-pip movement in USD/JPY.

Understanding this difference helps traders assess volatility and potential risk more accurately. This knowledge is particularly useful when comparing markets, such as index trading or commodities, where price movements are measured differently.

Ultimately, keeping track of the pip movements of currency pairs is integral for traders to make informed and strategic trading decisions in the Forex market.

For example, if the EUR/USD currency pair is trading at 1.1895 and moves to 1.1896, it has increased by one pip. The value of a pip can vary and is calculated by the differences in the exchange rates between the two currencies in the pair. In the EUR/USD example, a one-pip move would be 0.0001, or 0.01%.

If the same currency pair changed from 1.1895 to 1.1860, this would be a decrease of 35 pips. Because each currency is quoted in a different amount against the other and pips can vary, the value of a pip can be different from pair to pair. For example, a one-pip change in the USD/JPY pair would be significantly larger than a one-pip move in the EUR/USD pair.

Therefore, any change in value for an individual currency pair must be measured in terms of pips since this is the smallest amount of change to be measured.

Quick reference:

Some traders also apply pip-based strategies when using a commodities trading platform to compare volatility levels between Forex and commodity markets.

A pip works by measuring the smallest amount of change in the value of a currency pair. Typically, a pip represents the fourth decimal place in a quote (0.0001), or the second for JPY pairs (0.01).

Pips are used to calculate profits and losses when trading in the forex market. For example, if a trader gains 20 pips on EUR/USD with a $10-per-pip position, the profit equals $200. The same precision in price tracking is applied when trading via a crypto trading app, where even small movements can create notable returns.

The value of a pip can be calculated for any pair by multiplying the size of the trade by the size of the pip, in pips. For example, if a trade of 10,000 units was placed on the EUR/USD pair at a rate of 1.1000, the value of a pip would be calculated as follows:

10,000 × 0.0001 = 1 pip

This means that for every 0.0001 move in the exchange rate of the pair, the trade’s profit or loss will increase or decrease by 10 units of the currency in which the trader trades.

Pip Calculation Formula:

Example:

Many traders use a forex trading broker and a reliable CFD trading platform to automate these calculations and ensure real-time accuracy.

Pips play a critical role in Forex trading because they:

Keeping track of pip values also helps traders understand How to Use Pip Value for Position Sizing, ensuring trades align with proper risk limits and capital exposure.

At Eurotrader, a leading forex and stock trading broker, we help traders understand essential Forex concepts, such as pip values, spreads, and leverage. Use our free Pip Calculator to determine trade value, manage risk, and plan your next move with confidence. Join Eurotrader today to enhance your trading precision and strategy.