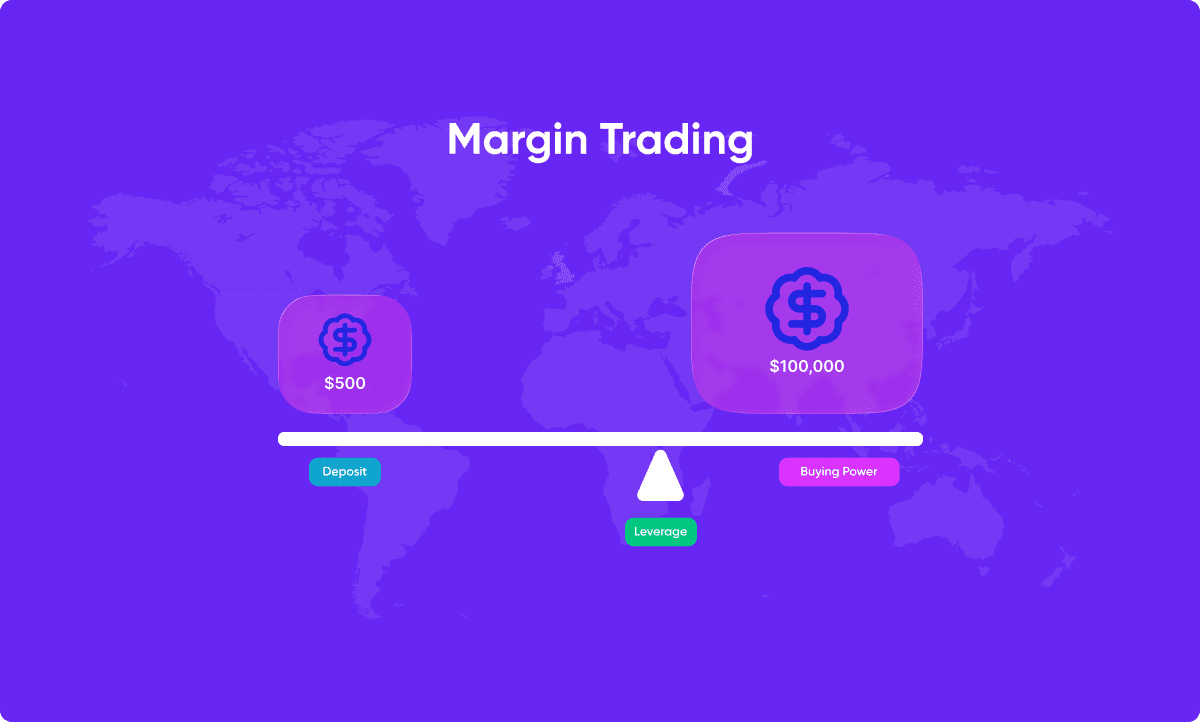

Margin in trading refers to the deposit required to open and maintain leveraged positions. It allows traders to control larger trades with less capital, effectively increasing their buying power. This practice is especially common in markets like Forex, where a forex trading brokerage typically offers high leverage to retail traders.

In this article, we’ll take a closer look at what margin in trading is and how to trade on margin effectively.

Margin in trading refers to the deposit required to open and maintain leveraged positions. It allows traders to control larger trades with less capital, effectively increasing their buying power. This practice is especially common in markets like Forex, where a forex trading brokerage typically offers high leverage to retail traders.

In this article, we’ll take a closer look at what margin in trading is and how to trade on margin effectively.

Buying on margin is a type of investment strategy that involves purchasing an asset, such as stocks, using borrowed funds provided by a broker. The borrower receives a loan from the broker, typically in the form of cash, and uses it to purchase the asset. The borrower will then pay back the loan plus interest, using the proceeds from any future sale of the asset.

This technique is generally considered riskier than unleveraged trading, since both profits and losses are magnified.

CFDs (Contracts for Difference) are derivative products that are traded on margin. They allow traders to open a position based on the amount of money they are willing to risk (the margin).

Steps to buy CFDs on margin:

Your account will then reflect profit or loss based on the difference between the opening and closing prices of the CFD.

Modern CFD trading is available across multiple markets, including digital assets through a crypto trading brokerage and even raw materials on a commodities trading platform.

A margin call is a broker’s demand for an investor who has purchased securities on margin to deposit additional funds in order to bring the margin account up to the minimum maintenance margin requirement. It is a warning that the investor’s equity in the account is falling below a certain level, and if it continues to decline, the broker may need to liquidate the investor’s holdings to cover the margin loan.

Free margin is the amount of money in your trading account that is available to open new positions. It is the difference between the equity in your trading account and the margin that is used to maintain open positions. It acts as an indicator of how much risk capacity remains in your account.

Margin trading can be profitable, but it carries significant risks, including:

The Benefits of Buying on Margin

Despite the risks, margin also offers potential benefits: