Commodity trading is where you buy and sell raw materials in an attempt to make a profit. This could include things such as oil, gold, silver, and wheat, and you do not have to own the commodities themselves to be a commodity trader. This means that you can take out leveraged contracts and positions that allow you to adopt much larger positions than you otherwise would be able to.

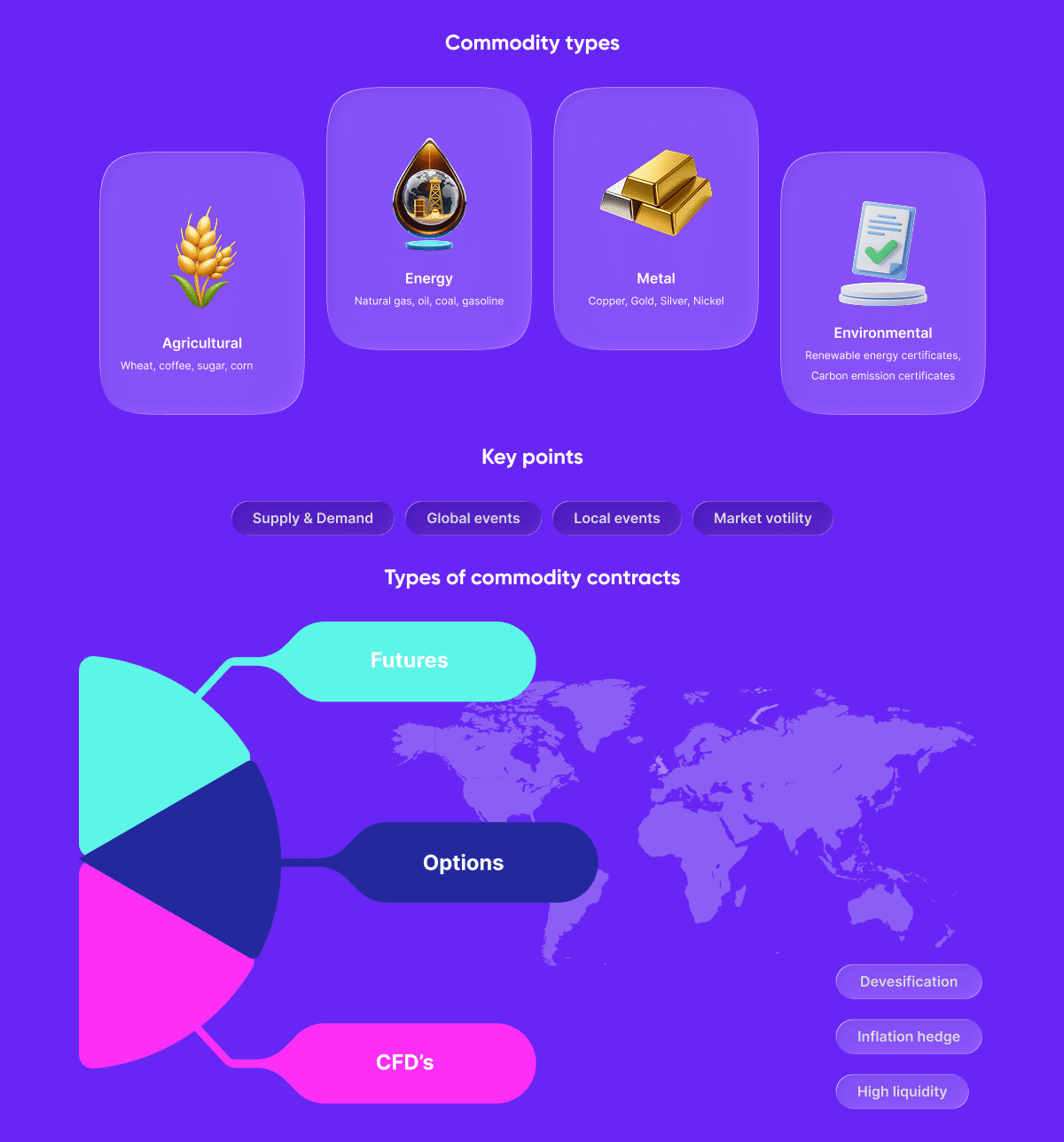

If you want to become a commodity trader, you will need to have a relationship with a trusted commodity trading broker who is tightly regulated. This is the person you will draw up the contract which you will then use to speculate. There are three main types of contracts that every commodity trader needs to be aware of:

Commodity traders are able to significantly derisk their positions by working across different assets and using different types of contracts. This allows them to create a highly diverse portfolio, which means any single event will typically not lead to large losses.

As with any class of assets, commodity prices are determined by a large number of interconnected factors. For example, the cost of oil can be affected by armed conflicts in oil-producing regions, new investments in other fuel sources, and a loss of confidence in oil companies, to name just a few factors.

Financial traders don’t have to own the commodities they are trading, which means they can be highly flexible with what they trade. Many elite traders and investors choose to hold commodity positions to safeguard their other investments against inflation. This is the reason why commodity trading is part of a diverse, robust portfolio rather than a distinct skill that is practiced by itself.

Many analysts will point to the fact that commodity prices tend to be more stable long-term than cryptocurrencies or shares in a specific public company. This is because while businesses can fail, the world will always need raw materials. Critics may say that commodity trading doesn’t generally offer the same potential for highly lucrative returns, but that misses the point.

A smart trader will take out positions across a diverse range of commodities at the same time as opening riskier but potentially more lucrative positions with other asset classes. What this does is add a more stable, lower-risk return to the wider portfolio.

The Eurotrader platform allows anyone to start commodity trading while mastering the basics and fundamentals. Our guide on how to start commodity trading is a great example of this approach and is designed to accelerate your learning curve quickly and efficiently.

Connect with our experts today, and they will guide you through everything you need to know to get started. It’s the exact same move that many of the world’s elite traders have already made.