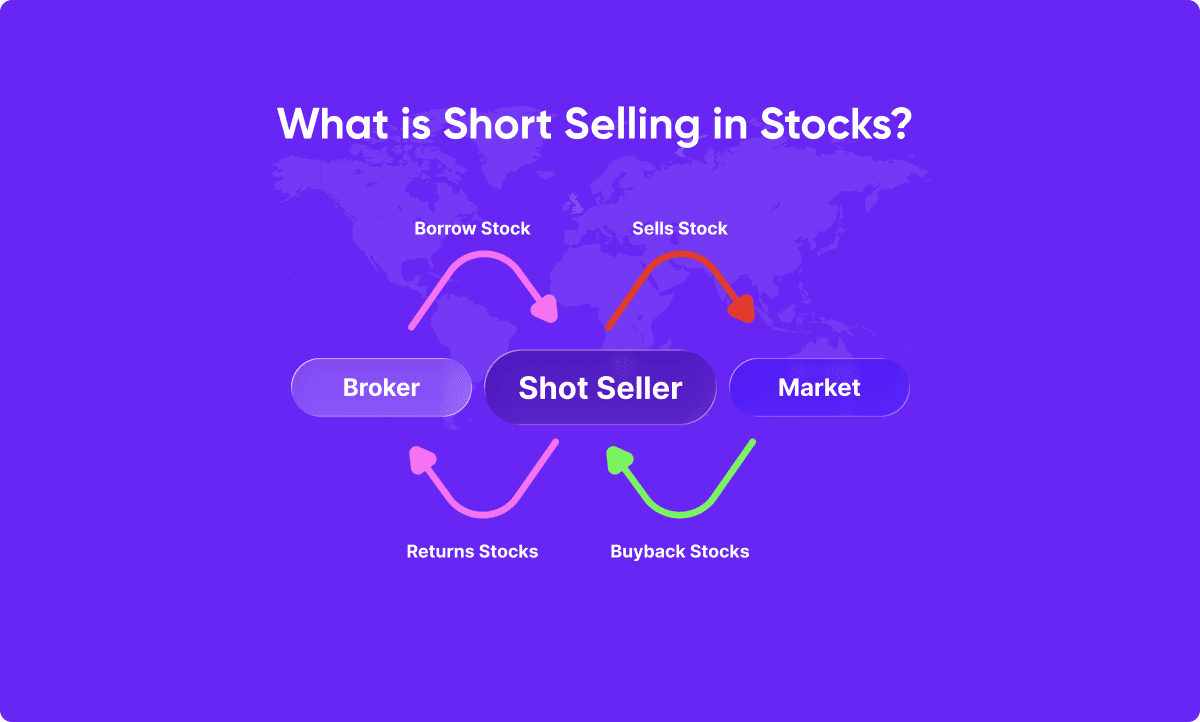

Short selling refers to a trading strategy where an investor sells shares they do not own, aiming to buy them back later at a lower price. Many traders execute short positions through a stock trading broker, who facilitates borrowing and selling shares efficiently.

When an investor takes a short position in a particular stock, they’re speculating that the price of the stock will decline. This strategy is high-risk and typically suited to experienced traders who understand leverage and volatility.

Learn more in our educational guide on How to Short Sell a Stock Safely, which covers margin use, position sizing, and risk management.

Shorting a stock requires access to a margin account, allowing the trader to borrow shares of the stock from their broker and sell them at the current market price. If the stock price falls, the trader buys back those shares at the lower price, returns them to the broker, and keeps the difference as profit.

However, if the stock price rises instead, the losses can be unlimited because there is no cap on how high a stock’s price can go.}

Steps to short a stock:

Let’s take everyone’s favorite stock: Tesla (NASDAQ: TSLA). It’s perhaps the most polarising company on the stock market and has plenty of bulls and bears. Suppose a trader wants to short Tesla when it trades at $500 per share. The short seller borrows 1,000 shares of Tesla at $500.00, worth $500,000 in total.

The short seller immediately sells these shares to buyers at the current market price of $500.00. Now, the short seller plays the waiting game, and if their speculation is correct, they should be able to make a nice profit.

Several weeks later, the stock price of Tesla fell to $400.00 per share. The short seller will then close their short position and purchase 1,000 shares of Tesla stock at $400.00. These shares will be ‘returned’ to the broker, and the profit left in the short seller’s account equals $100,000 ($500,000 – $400,000).

If the price had risen to $600 instead, the short seller would have lost $100,000, showing how quickly losses can escalate.

Similar strategies can also be applied on an indices trading app, allowing traders to speculate on the performance of entire stock indices such as the S&P 500 or NASDAQ.

Like with any form of investing, there is inherent risk in short selling stocks. Short selling can be devastating to an investor if they speculate incorrectly on a stock price declining. If the stock price rises, there are potentially unlimited losses.

Going back to our Tesla example, if the stock price rose to $600.00 instead of falling to $400.00, the short seller would incur a loss since they would have to ‘cover’ their short position by repurchasing those shares at a higher price.

In a real world example, this is exactly what happened to hedge funds in the meme stock short squeeze event in early 2021. Institutions like Melvin Capital held significant short positions in both GameStop (NYSE: GME) and AMC (NYSE: AMC), so when retail investors artificially boosted the prices of the stocks, hedge funds had to cover their short positions by buying back shares at a higher price. This led to the stock price skyrocketing in what is known as a short squeeze.

Another risk with short selling is that a brokerage can request a margin call. A margin call is when the brokerage requests that the amount borrowed is paid back immediately or financial penalties can be incurred. Failing to meet a margin call can lead to forced liquidation and substantial losses.

Discover key risk strategies in our expert guide on How to Manage Risks When Short Selling to protect your capital during volatile market movements.

As with non-short selling, the ultimate goal is to make a profit. However, shorting a stock isn’t always bearish. It can also serve as a hedge to protect long positions from temporary declines.

Shorting a stock can be used as a hedge to protect a long position in a stock. This means that the short seller is actually bullish over the long-term, but is using a short position to capture any volatility or downside during that time.

When executed correctly, short selling can provide investors with a large potential profit with minimum initial investment. Since most short selling is used through margin, much of the actual investment is borrowed money. This leverage amplifies both profits and losses, so risk management is essential.

Some traders diversify across markets by combining stock positions with commodities trading online, helping balance exposure and capitalise on global trends.

There are additional costs to shorting stocks on your chosen CFD trading platform, such as margin interest on the borrowed amount and brokerage fees for executing trades. You’ll need to keep this in mind.

Costs to consider: