Crypto trading is when you buy and sell cryptocurrencies such as Bitcoin and Ethereum in line with a strategy that is designed to make you money. The goal is to consistently profit from price fluctuations so that you can buy when they cost less and sell when they cost more. This is no different from any other type of trading; it’s just that this time the asset you are buying and selling is a cryptocurrency.

Buying and selling cryptocurrencies on exchanges is a common approach to trading and involves the following key points:

Having a strategy in place that allows you to enter the market when it is low and exit when it is high is the fundamental goal of crypto trading on exchanges. This is the same as trading any other asset.

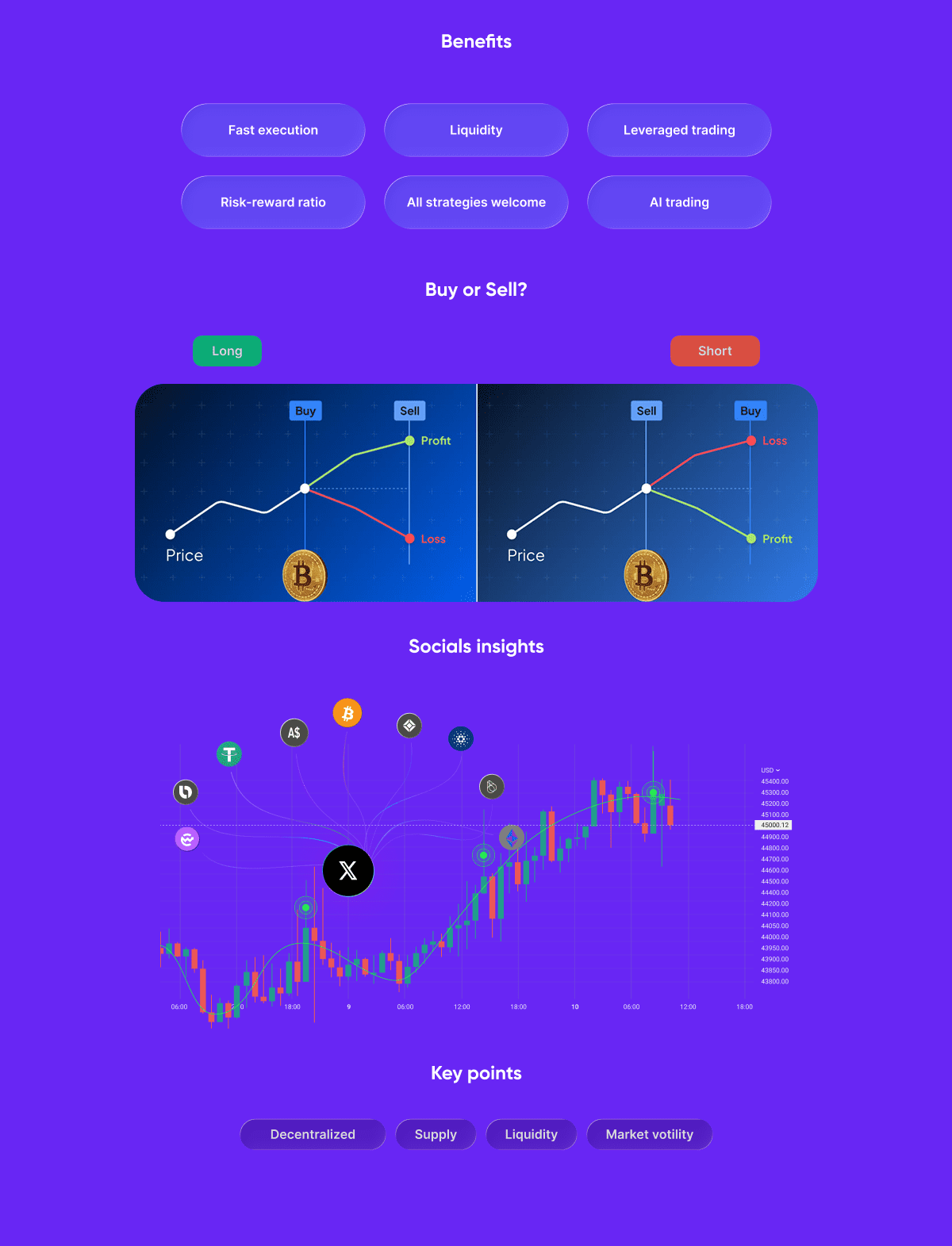

A Contract For Difference (CFD) is a financial tool that allows you to speculate on price changes without owning the asset itself. In this case, you are effectively making a financial bet on whether the value of a cryptocurrency will go up or you down. This approach provides several additional options to standard exchange-based trading:

A Contract For Difference (CFD) is a financial tool that allows you to speculate on price changes without owning the asset itself. In this case, you are effectively making a financial bet on whether the value of a cryptocurrency will go up or you down. This approach provides several additional options to standard exchange-based trading:

Eurotrader exists to make entering the market as quick and easy as it should be. If you want to trade crypto CFDs in a way that maintains your confidentiality and security, our platform is ready and waiting.

Because we want you to benefit from using our platform, here are the key things you should know about crypto trading:

Reading our guide on how to start crypto trading will walk you through the next steps so that you can understand where to go next.