In the world of online trading, understanding risk management is essential for success. One crucial aspect of risk management that traders often encounter is the Stop Out level. In this article, we’ll delve into what Stop Out is, how it works, and why it’s vital for every trader to grasp its significance.

Stop Out is a risk management mechanism implemented by brokers, such as a forex trading brokerage, to protect traders from excessive losses. It represents the point at which a trader’s account equity falls below a certain threshold, typically expressed as a percentage of the margin used to open positions.

When a trader’s account equity reaches the Stop Out level, the CFD trading broker will automatically close out (liquidate) some or all positions to prevent further losses and keep the account from going negative. This automatic closure is the Stop Out itself.

A margin call is slightly different; it’s a warning that your equity is running low and you need to add funds or close trades. If you don’t act, the Stop Out level may then be triggered.

To fully comprehend Stop Out, it’s crucial to understand the concepts of margin and leverage. Margin is the amount of money required to open a trading position with your online trading broker, while leverage allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also magnifies losses and increases the risk of triggering a Stop Out.

Stop Out serves as a safeguard against account depletion and helps traders manage risk effectively. By setting appropriate Stop Out levels and adhering to risk management principles, traders can protect their capital and mitigate the impact of adverse market movements.

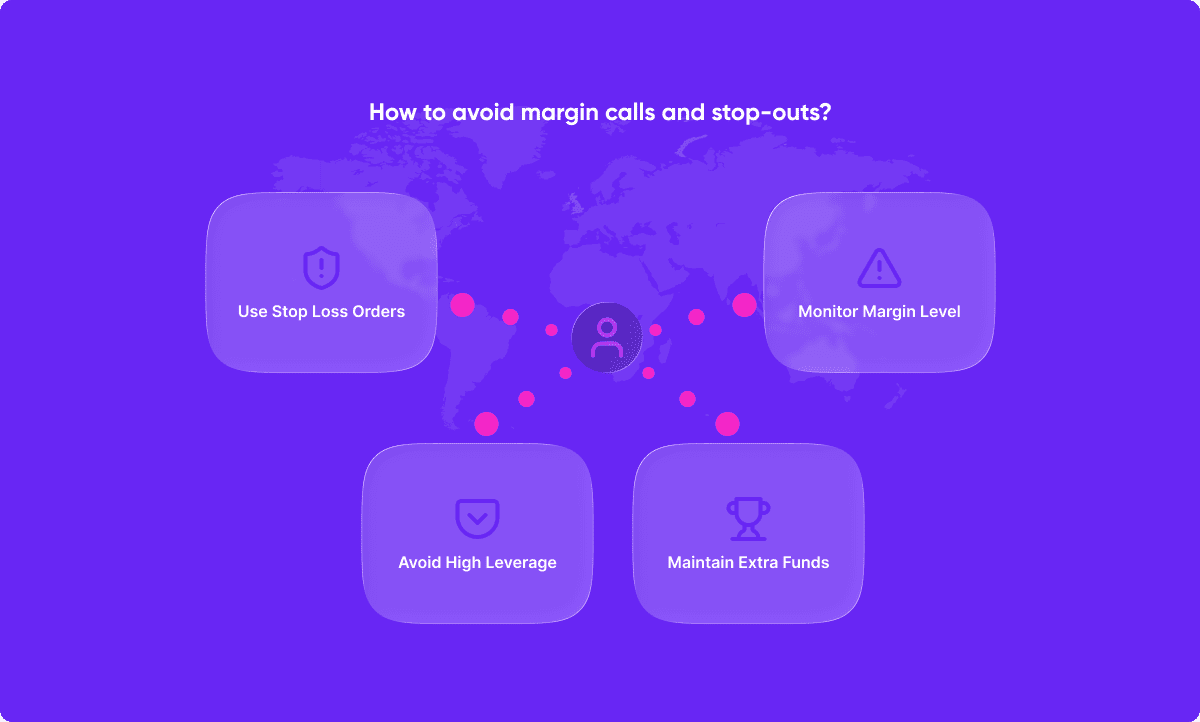

Here are some practical ways to reduce the chance of your account hitting Stop Out:

In conclusion, Stop Out is a fundamental aspect of risk management in online trading. By understanding how Stop Out works and implementing proper risk management techniques, traders can protect their capital and navigate the markets with confidence. Remember, discipline and prudent risk management are key to long-term trading success.

Disclaimer

Eurotrader doesn’t represent that the material provided here is accurate, current, or complete, and therefore shouldn’t be relied upon as such. The information provided here, whether from a third party or not, isn’t to be considered as a recommendation, or an offer to buy or sell, or the solicitation of an offer to buy or sell any security, financial product, or instrument, or to participate in any particular trading strategy. We advise any readers of this content to seek their advice.