Category: Blog

Understanding Inflation: From Basics to Exchange Rates

What is Inflation?

Inflation is essentially the rate at which the general level of prices for goods and services rises. Imagine you could buy a loaf of bread for $1 last year, but this year, the same bread costs $1.10. The increase in price is a simple example of inflation. In other words, as inflation rises, every dollar you own buys a slightly smaller percentage of a good or service.

Inflation is Additive

- Cumulative Nature: Inflation tends to be a cumulative process. This means that the increase in prices generally adds up over time, rather than resetting or reverting back to previous levels. For example, if the inflation rate is 2% per year, a product costing $100 this year would cost $102 the next year, and so on, each year adding on top of the last.

- Compound Effect: Just like compound interest, inflation compounds over time. This means that the price increases build upon each other. In a long-term perspective, this effect can be substantial, causing prices to increase significantly over decades.

How Does Inflation Affect Consumers?

For consumers, inflation means the purchasing power of their money decreases. If your income doesn’t increase at the same rate as inflation, you’ll find that you can afford less than before. This situation can strain budgets, especially for essentials like food, housing, and healthcare. Inflation also affects savings; money saved today might be worth less in the future if inflation is high.

Central Banks and Inflation

Central banks, like the Federal Reserve in the U.S. or the European Central Bank (ECB) in Europe, play a crucial role in managing inflation. Their primary tool is adjusting interest rates. When inflation is high, central banks may increase interest rates, making borrowing more expensive. This action can slow down spending and investment, reducing the demand for goods and services, and eventually, slowing down inflation.

Inflation and Exchange Rates: EUR to USD Example

Exchange rates are affected by inflation. When a country experiences higher inflation compared to others, its currency value tends to decrease relative to other currencies. Let’s consider the Euro (EUR) and the U.S. Dollar (USD). If inflation in the Eurozone is higher than in the U.S., the value of the Euro may decrease compared to the Dollar. This change means that it will take more Euros to buy the same amount of U.S. Dollars. Conversely, if inflation is higher in the U.S., the Dollar might weaken against the Euro.

The Interrelation

- Scenario 1: Country A has higher inflation than Country B. As a result, Country A’s currency is likely to depreciate against Country B’s currency.

- Scenario 2: To combat high inflation, Country A’s central bank raises interest rates. This makes borrowing more expensive, potentially slowing economic activity and reducing inflation.

- Scenario 3: The higher interest rates in Country A now make it more attractive to foreign investors. They exchange their currency for Country A’s currency to invest there, increasing the demand for Country A’s currency and causing it to appreciate.

Example: EUR and USD

Consider the Euro (EUR) and the U.S. Dollar (USD). If the Eurozone has higher inflation than the U.S., the Euro may weaken against the Dollar. If the European Central Bank raises interest rates to combat this inflation, it might initially attract investment into the Eurozone, strengthening the Euro. However, this could also slow down the Eurozone’s economy, which in turn might impact the Euro’s strength.

Understanding these dynamics is key to grasping international finance and economics. The interplay between inflation, interest rates, and exchange rates is a delicate balance that central banks navigate to maintain economic stability.

In summary, inflation is a complex economic phenomenon that impacts consumers, central banks, and international currency markets. Understanding its dynamics, especially in the context of major currencies like the Euro and the U.S. Dollar, is essential in today’s interconnected global economy.

Bad Santa Rally

Hello, Investors!

As the festive season approaches, there’s a phenomenon in the stock market that often catches the eye of traders and analysts alike – the “Bad Santa” Christmas stock market rally. But what exactly is this phenomenon, and why does it matter to investors like you? Let’s dive in.

What is the “Bad Santa” Rally?

Traditionally, the stock market experiences a ‘Santa Claus Rally’ during the last week of December and the first couple of trading days in January. This is typically a period of increased stock prices, attributed to holiday cheer, tax considerations, and institutional investors settling their books.

However, there are years when this expected rally turns into what’s colloquially known as a “Bad Santa” rally. This refers to a scenario where, contrary to expectations, the market experiences a downturn or increased volatility during these festive days.

Causes of a “Bad Santa” Rally

Several factors can contribute to a “Bad Santa” rally:

1. Economic Indicators: Negative economic data or forecasts can dampen investor sentiment, leading to sell-offs.

2. Geopolitical Tensions: Global uncertainties or political instability can make investors cautious, impacting markets.

3. End-of-Year Portfolio Adjustments: Sometimes, institutional investors might rebalance or adjust portfolios for tax purposes, leading to unexpected market movements.

4. Low Trading Volumes: With many investors on holiday, lower trading volumes can lead to increased volatility.

How Should Investors Respond?

If you find yourself in the middle of a “Bad Santa” rally, here are a few tips:

– Stay Calm: Market fluctuations are normal. Avoid making hasty decisions based on short-term movements.

– Review Your Strategy: Ensure your investment strategy aligns with your long-term goals and risk tolerance.

– Opportunity to Buy: Sometimes, a downturn can present buying opportunities for undervalued stocks.

– Stay Informed: Keep an eye on market news and trends to make informed decisions.

Conclusion

While the “Bad Santa” rally might sound ominous, it’s just another aspect of the ever-dynamic stock market. Understanding these trends helps in making informed investment decisions and maintaining a healthy portfolio.

Here’s to making smart moves this holiday season and beyond!

Guide to Trading Strategies

Introduction:

With so many markets to trade, how do you know what strategies work best for each?

In this guide, we’ll break down suitable strategies for forex, crypto, stocks, and other major markets.

Forex Strategies

For currencies, leverage means high volatility. This favors strategies like:

-

Breakout – Trade accelerations in volatility after ranges or consolidation.

-

Momentum – Follow trends amplified by interest rate differentials.

-

News-based – Macro moves based on GDP, NFP reports, etc.

Crypto Strategies

Crypto’s extreme volatility suits strategies like:

-

Momentum – Ride the waves of speculation and hype/panic cycles.

-

Swing – Catch major swing highs and lows in a range-bound market.

-

Arbitrage – Exploit pricing inefficiencies across exchanges.

Stock Strategies

For stocks, broader economic shifts dictate trends, favoring strategies like:

-

Fundamental – Analyze financials like P/E ratios and growth.

-

Chart patterns – Trade tactical formations like wedges, channels.

-

Quantitative – Data-driven approaches based on factors like valuation.

Commodities Strategies

For commodities, seasonal supply/demand and roll yields influence prices. Useful strategies are:

-

Curve trading – Profit from rolls and contango/backwardation.

-

Mean reversion – Trade reversals to the mean.

-

Seasonal patterns – Take positions ahead of known periods of strength/weakness.

Conclusion:

Match strategies to each market’s unique attributes.

A momentum system in crypto may fail in stocks.

Stay flexible and realize strengths and weaknesses vary.

Combining complementary strategies expands opportunities.

7 Technical Indicators for Beginner Traders

Introduction:

Starting out in trading can feel overwhelming looking at the array of technical indicators available.

However, not all indicators are created equal.

Here are 7 of the most useful indicators that every beginner trader should know, along with tips on how to best apply them.

#1: Moving Averages (MA)

Moving averages smooth out price action and help identify bias and potential support/resistance levels.

Use the 50 & 200 MA to determine overall trends on higher time frames.

On lower time frames, shorter MAs (5 & 20) provide dynamic levels.

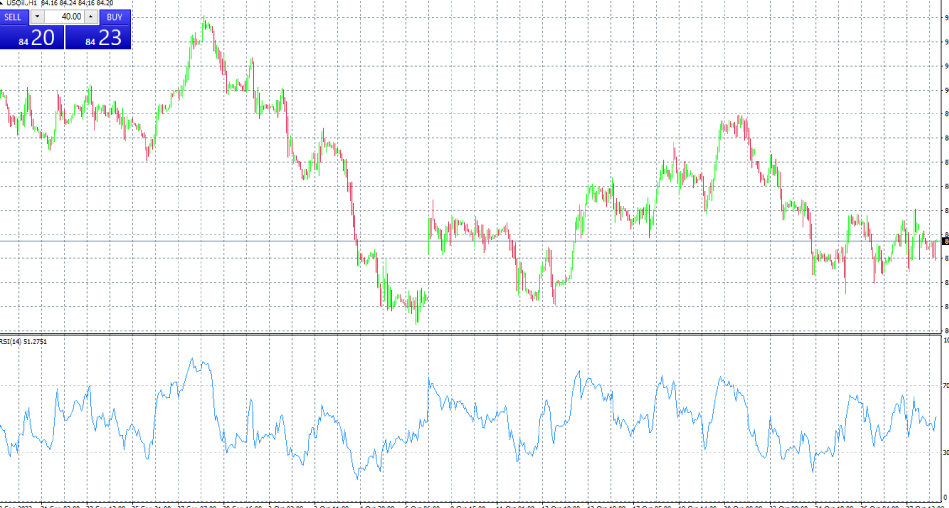

#2: Relative Strength Index (RSI)

RSI measures the speed and magnitude of recent price movements to identify oversold and overbought conditions.

An RSI below 30 signals an oversold bounce is likely, while over 70 indicates a market topping.

#3: MACD (Moving Average Convergence Divergence)

The MACD crossover system reveals shifting momentum through the interaction of its two moving averages.

Trade signals occur when the shorter MA crosses above or below the longer MA.

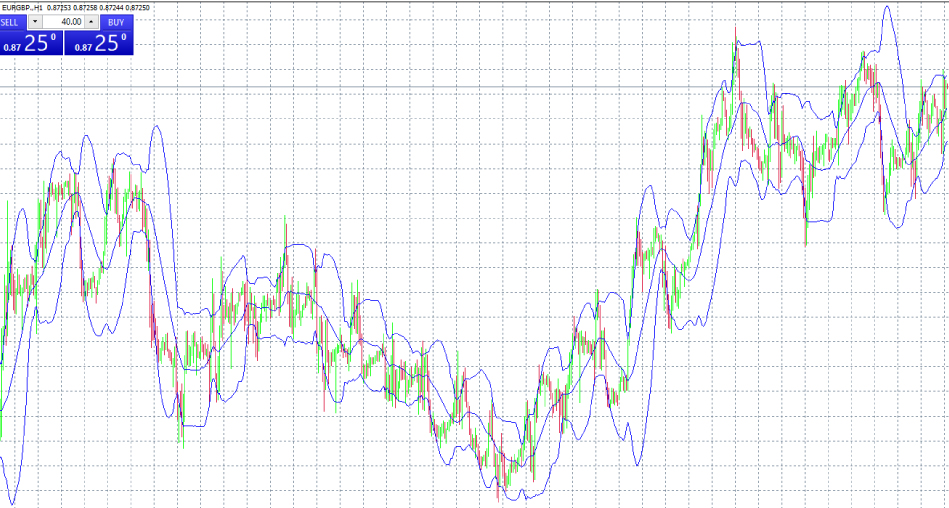

#4: Bollinger Bands

Bollinger Bands plot volatility-based envelopes above and below a simple moving average.

Applying Bollinger Bands shows whether prices are relatively high or low on a normalized basis.

#5: Stochastic Oscillator

This momentum indicator identifies oversold and overbought levels via a scale from 0 to 100. S

ignal line crossovers and extremes can reveal entry and exit points.

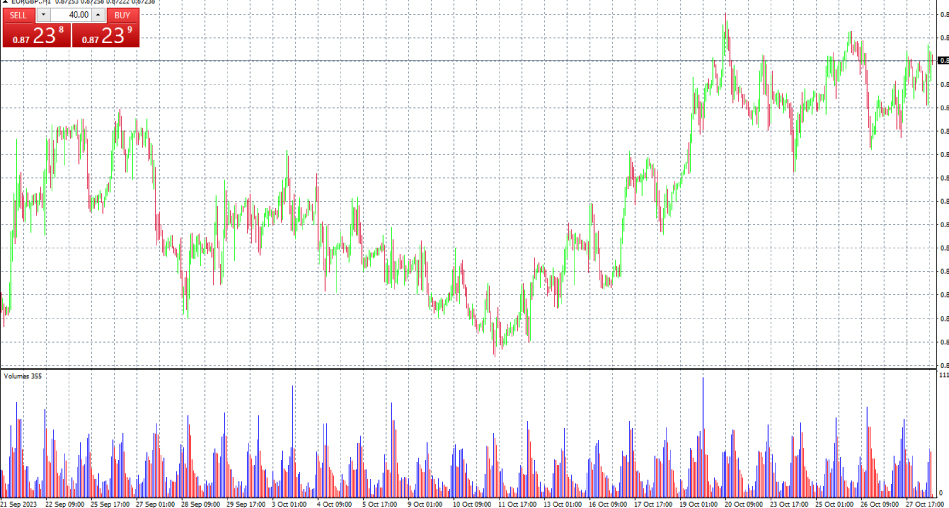

#6: Volume

Analyzing volume provides confirmation of major price moves and breakouts.

Increasing volume points to a high conviction move, while decreasing volume suggests fading momentum.

#7: Support and Resistance

Horizontal support and resistance levels form important potential reaction points where orders cluster.

These derive from previous peaks and lows and signal areas for entries or stop losses.

Conclusion:

Mastering these seven foundational technical indicators will provide beginner traders with a versatile toolkit to find high-probability setups across various markets and timeframes.

Start applying these to develop your analytical skills.

How the 2024 US Elections Could Impact Currency Markets

As the 2024 US presidential elections draw closer, volatility and uncertainty around how the results could affect currency trading markets is rising.

Eurotrader analyzes potential currency market movements based on the two likely scenarios on election night – a Republican or Democratic win.

If President Trump wins re-election, the initial reaction would likely be a surge in stock futures, relative strength for the dollar and falling gold prices on perception of continued deregulation and corporate tax policies.

However, lingering concerns around factors like expanding budget deficits, trade protectionism with China could weaken longer term confidence.

This may limit potential gains for the USD index.

Conversely, election of a Democratic candidate could prompt declines for US equities and dollar index with monies shifting toward safe havens like Gold and Japanese Yen. But it’s worth noting that initial volatility and risk-off flows tend to stabilize relatively quicker under a Democrat expansion of social spending. The USD could also find support long term if proposed infrastructure and employment gains manifest.

With a deeply polarized electorate, result uncertainty extending from election night through end of year can make dollar-based currency pairs like EUR/USD, GBP/USD volatile. Eurotrader will be on ground election night into early 2021 guiding traders to hedge risks and leverage opportunities across currencies and assets amidst political turbulence in Americas’ largest economy.

10 Tips to Improve Your Trading in 2024

As we step into 2024, we’re filled with optimism and enthusiasm for the trading opportunities that await us.

At Eurotrader, we’re committed to helping you navigate the dynamic world of CFD trading, whether it’s in FX, precious metals like gold, or various indices.

Here are 10 tips to enhance your trading experience and pave the way for a prosperous year:

1. Stay Informed: Keep abreast of global economic trends and news that can impact the markets. Knowledge is power in trading.

2. Plan Your Trades: Develop a clear trading strategy and stick to it. Remember, a well-planned trade is half the battle won.

3. Manage Risk: Use risk management tools and techniques to protect your investments. Remember, preserving capital is as important as making profits.

4. Continuous Learning: The market is always evolving. Stay curious and educate yourself about new trading strategies and instruments.

5. Embrace Technology: Utilize advanced trading platforms and tools to gain an edge in your trading activities.

6. Stay Patient: Patience is a trader’s virtue. Wait for the right opportunity rather than making impulsive decisions.

7. Diversify Wisely: Spread your investments across different assets to mitigate risk.

8. Record and Review: Keep a trading journal to track your progress and learn from both successes and mistakes.

9. Practice Emotional Discipline: Keep your emotions in check. Avoid the pitfalls of fear and greed.

10. Seek Expert Advice: Don’t hesitate to consult with our team of experts for insights and guidance.

As we embark on this journey together, remember that we are here to support you every step of the way.

Here’s to a year of insightful trading and remarkable achievements!

Wishing you a prosperous and successful trading year in 2024!

The Faltering Fortunes of Silicon Valley Bank

Introduction:

Silicon Valley Bank has long been the go-to financial institution for tech startups and investors in the Bay Area.

However, SVB now faces its own struggles that mirror the broader challenges confronting Silicon Valley.

SVB Stock Crash:

SVB’s stock plunged over 75% in 2022 amidst the tech downturn.

Originations slowed as funding dried up for unprofitable startups. Higher loan losses are expected in a recession.

Exposure to Volatility:

SVB’s heavy concentration on the volatile startup sector backfired as rising rates and plunging valuations slammed tech. Diversification could have reduced risks.

Leadership Uncertainty:

Long-time CEO Greg Becker announced his departure in January 2023 without a permanent successor lined up, creating uncertainty atop management.

Stiffening Competition:

As tech hubs spread globally, SVB faces more competition both from major banks and smaller regional rivals focused on startups.

Missed Opportunity in Crypto:

Unlike some competitors, SVB failed to capitalize much on the cryptocurrency boom to expand its client base before the 2022 crash.

SVB now confronts the downsides of its strategic dependence on Silicon Valley startups. With the region itself struggling, SVB appears vulnerable going into an economic slowdown. Defending its market position will prove challenging.

Conclusion:

SVB’s fortunes remain tied to those of Silicon Valley.

As the tech center faces threats to its elite status, SVB must similarly adapt to preserve its long-held position as the startup bank of choice.

Expanding beyond its geographic and sector focus could foster stability when Silicon Valley falters.

Trading Psychology for Success

Introduction:

Trading strategy is only half the equation – you must also develop the proper trading psychology and mindset to execute your system effectively.

Trading requires immense mental strength.

Here’s why every trader needs to focus on their psychology:

Overcome Emotions

Emotions like fear, greed and impatience will sabotage your results.

Developing emotional control and discipline is critical.

Build Confidence

Success breeds confidence.

Work on your mindset to trade without self-doubt or hesitation when opportunities arise.

Strengthen Discipline

Sticking firmly to your trading plan requires immense discipline. Psychology work enhances willpower.

Adapt During Drawdowns

Drawdowns test your resolve.

Maintaining perspective minimizes panic selling and revenge trading.

Manage Risk

Having the right risk mentality ensures you size trades appropriately and follow stop losses.

Avoid Tilt

Making reckless trades trying to recover losses is known as tilt.

Managing psychology prevents tilt episodes.

Trade in The Zone

Getting in the zone leads to peak performance.

You tap intuition, flow, clarity and optimal arousal.

Focus on Process Over Results

Outcomes are out of your control.

Make sound decisions aligned with your process.

Cultivate Patience Patience

Patience comes from a mindset of trusting your edge to play out over time.

Avoid forcing trades.

By strengthening trading psychology, you gain the strategic edge to stick to your system, manage risks, and ultimately outperform the market.

Master your mindset along with your methods.

Conclusion:

Skilled trading requires just as much psychological mastery as market knowledge. The best traders work relentlessly on their mindset discipline to execute flawlessly. Make psychology a priority in your journey to trade at peak performance.

Risk Management Strategy

Introduction:

Robust risk management is the key to long-term trading success and protecting your hard-earned capital.

Without prudent risk controls, it’s easy to get wiped out during inevitable drawdowns.

In this post we’ll explore pro tips to upgrade your risk management approach:

Use Stop Losses on Every Trade

Stop losses minimize damage when you’re wrong.

Place them at technical levels where your trade thesis would be invalidated if hit.

Exit trades quickly when things don’t go as expected.

Size Positions Appropriately

Position sizing is critical. Risk no more than 1-2% of capital per trade.

Size down when on a losing streak. Take smaller positions in volatile markets.

Manage Your Overall Risk

Consider risk across your entire portfolio. Diversify across assets and strategies.

Limit your total simultaneous open risk. Avoid overexposure.

Have a Drawdown Limit

Define the maximum peak-to-valley drawdown you can stomach, like 10-20% of capital.

If hit, reevaluate your approach before continuing trading.

Don’t Average Down

Throwing good money after bad by averaging losing positions rarely ends well.

Stick to your stop loss rules and maximum loss per trade.

Follow Broader Risk Management Guidelines

Stick to trading only liquid markets you understand, and avoid excess leverage.

Going broke slowly is still going broke.

Track Your Risk Metrics

Analyze metrics like your risk/reward ratios, win rates, Sharpe ratio and beta to optimize your risk efficiency.

Learn to Be Wrong Small and Right Big

Master cutting losses quickly while allowing winners to run.

The key is asymmetry between your average winner and average loser.

By making ongoing improvements to your risk management process, you protect profits while weathering markets’ inevitable ups and downs.

Defense wins championships in trading.

Conclusion:

With robust risk controls, you can trade confidently knowing one blow up won’t wipe you out.

Allow your edge to play out over the long run. Keep fine tuning your risk management as the markets evolve.